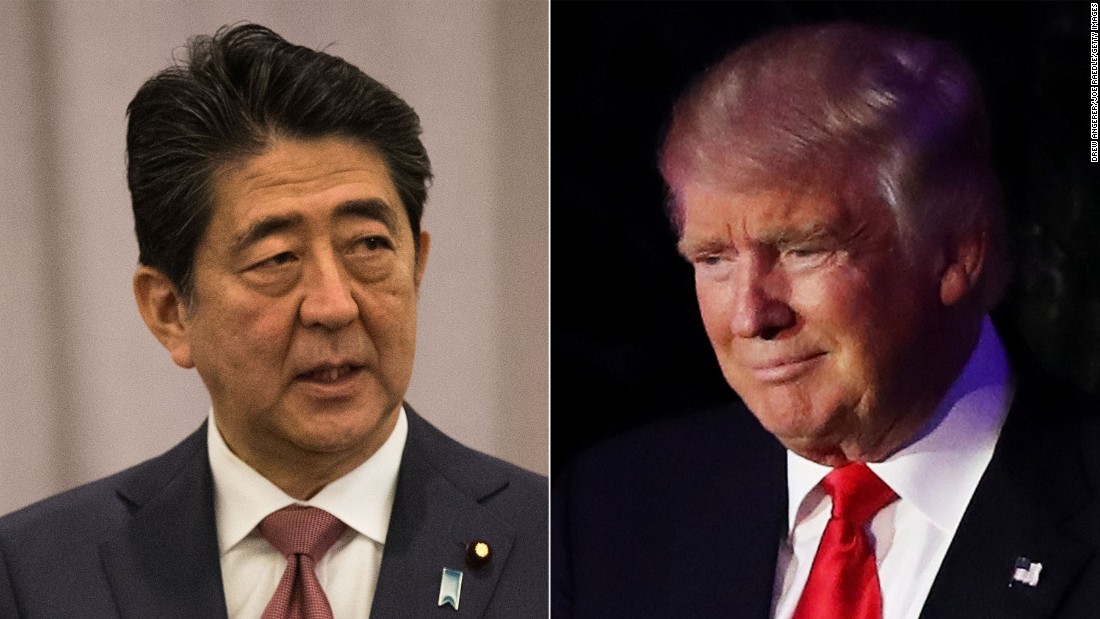

Abe faces tough road with Trump on trade

Politico | 9 February 2016

Abe faces tough road with Trump on trade

By Adam Behsudi

Japanese Prime Minister Shinzo Abe arrives in Washington on Friday to a word of caution from most experts: This is not the time to agree to bilateral trade negotiations with the United States.

Abe will likely take that advice to heart when he meets with President Donald Trump. The prime minister is expected to propose an initiative to increase job-creating Japanese investments in the U.S., which could buffer expectations that the country immediately dive into bilateral trade talks.

“They are going to talk the language of Trump by coming with a package describing how to increase employment in the U.S.,” said Mireya Solís, a Japan expert at the Brookings Institute.

The stakes are high for Abe as he desperately tries to find some shared initiative with the White House that would satisfy Trump’s “America first” vision on trade, which includes an almost singular focus on driving down the trade deficit.

Japan faces an uphill battle. The U.S. this week released numbers showing a $68.9 billion trade deficit with Japan in 2016, which is second only to China. Abe also faces a president not shy about criticizing both domestic and foreign companies if he doesn’t think they are working for American interests. Trump rebuked Japanese automakers last month for exporting vehicles “by the hundreds of thousands on the biggest ships I’ve ever seen.”

Trump’s views on how to fix trade issues could quickly turn toxic for Japan in the context of bilateral negotiations, where the U.S. administration could demand the country make more concessions in its hypersensitive agriculture sector while offering even less on automobiles than what Tokyo got in the now defunct Trans-Pacific Partnership.

“Prime Minister Abe looks like he’ll be offering up some significant Japanese investments in the U.S. in energy and infrastructure, and that could create many new jobs,” said Dan Bob, a senior fellow at the Sasakawa Peace Foundation USA, a think tank that focuses on the U.S.-Japan relationship.

“While I don’t think Mr. Abe will commit to a bilateral trade negotiation, President Trump will be able to say the visit was a success,” Bob added.

But Abe will no doubt be under immense pressure from the White House to allow his country to serve as a test case to exhibit the Trump administration’s self-perceived prowess at the negotiating table.

“There’s going to be a lot of pressure because the Trump team wants to demonstrate they aren’t trashing the trade agenda, but creating better trade deals,” Solís said.

The Japanese government has long touted its investments and job creation in the United States. Japan’s investments between 2002 and 2015 totaled $411 billion and its multinational enterprises employed 839,000 Americans in 2014, according to the Commerce Department.

In the fight to win support for the TPP in Congress, Japanese officials and business groups regularly trotted out charts and graphs showing the impact of Japan’s investments in the U.S. But the strategy failed to gain much traction among lawmakers, who saw the trade deal quickly become a political piñata ahead of last year’s elections.

Abe has remain committed to the TPP despite its fading prominence in the U.S. Japan is the only country of the 12 participants so far to ratify the deal. So any consideration of bilateral talks would likely be motivated by a larger goal, such as getting back to a regional pact, said one expert.

“If humoring the Trump team’s idea that bilateral deals are better means getting back to a broader, multilateral Asia-Pacific deal, then it may be Japan’s interest to pursue this,” said Michael Green, senior vice president for Asia at the Center for Strategic and International Studies.

An advocate for TPP

Four years ago, Abe was only three months into his second, nonconsecutive term as leader when he made a calculation: Japan would join the TPP talks to counter China’s rising influence and possibly inject some growth into the country’s slowing economy.

The decision, however, put Abe in direct conflict with his country’s elderly, yet immensely powerful farmers, who are kingmakers to his Liberal Democratic Party. Joining the talks meant Japan had to place its “sacred” sectors — rice, beef, pork, dairy and wheat — on the negotiating table.

The U.S. also immediately tempered the Japanese auto industry’s expectations, making clear from the start that American tariffs on cars and trucks would remain in place for decades.

Still, Abe persevered, elevating the TPP to a key pillar of his plan for economic growth. After months of agricultural talks with the U.S., Tokyo agreed to give American beef and pork producers unprecedented access, while U.S. dairy and rice farmers got some modest gains.

Tokyo’s concessions came with the reward of bringing Japan into the proposed 12-country, U.S.-led trading bloc, which would set up supply chains and trading rules that would directly counter China.

“You don’t have that dynamic in a bilateral,” Solís said.

Thus, a renewal of bilateral talks with the Trump administration would re-expose Abe to politically challenging demands without providing the benefits promised by the TPP.

U.S. pork, beef and dairy farmers would be eager to see how they could gain even better access to Japan’s markets than they would have received under the mega-regional deal. The National Pork Producers Council and National Cattlemen’s Beef Association sent a letter to Trump this week urging him to get bilateral talks started.

“The deal we were going to get in TPP was pretty good,” said NPPC spokesman Dave Warner. “For U.S. pork, it was actually very good.”

U.S. beef producers also saw immense value in the agreement, which would have lowered tariffs from 38.5 percent to 9 percent in what was their largest Asian market.

But dairy producers were lukewarm about Japan’s market access offer in the pact. Tokyo had to also weigh the aggressive demands of New Zealand and Australia, both major dairy exporters. U.S. producers say they could capitalize on Japan’s massive demand for cheese, butter, whey and skim milk powder through a bilateral deal.

“Part of the problem with TPP was you had so many different countries with an interest in exporting dairy products to Japan,” said Jaime Castaneda, senior vice president of strategic initiatives and trade policy for the National Milk Producers Federation. He said his organization is very supportive of a bilateral deal with Japan.

Currency concerns

Trade talks could also back Japan into a corner on its monetary policies. Ford Motor Co. has long argued that Japan’s interventions in its currency market have given Japanese auto exports a trade advantage. Most economists, however, would disagree that Japan is currently devaluing the yen.

More troubling for Japan is the fact that Trump is lumping the country’s monetary policies in with China. During the campaign, he called for Treasury to declare Beijing a currency manipulator on day one of his presidency — a promise he has yet to fulfill.

“You look at what China’s doing, you look at what Japan has done over the years,” Trump said after a meeting with pharmaceutical executives last week. “They play the money market, they play the devaluation market, and we sit there like a bunch of dummies.”

The TPP set a nonbinding “forum” for countries to discuss monetary policies but stopped short of enforceable rules.

“Japan is never going to agree to binding or automatic corrections to exchange rate fluctuations,” said Green of CSIS.

Auto rules

Another reason why Japan will probably be hesitant to negotiate with Trump is the uncertainty about whether its massive auto industry would gain anything through a trade deal.

Trump’s negotiators inevitably would push Japan to agree to a higher rule of origin on its vehicles, setting an increased threshold for the amount of content that must originate in either country for cars or trucks to enjoy lower tariffs.

Commerce secretary nominee Wilbur Ross, who is slated to become a major voice guiding Trump’s trade policies, criticized the TPP’s rule of origin on autos during his confirmation hearing last month.

Japan had agreed to a 45 percent rule of origin for finished automobiles, which would have allowed Japanese companies to continue to source parts from more countries outside of the TPP, including China. Congressional Democrats blasted the rule as weaker than NAFTA’s 62.5 percent threshold, even though the two deals use different methodologies that make the difference less stark than at first glance.

Asked whether Japan could agree to tighter auto rules than what it got in the TPP, Bruce Hirsh, a former senior USTR official involved in negotiating Japan’s bilateral terms in that deal, explained that Tokyo would probably weigh a number of factors.

“Some Japanese companies might be able to meet a stricter rule, but others might not,” he said. “Further, there are going to be a lot of factors the Japanese government would consider, including the precedent it would set for their other FTAs.”