India, Mauritius to meet next month to review tax treaty

Press Trust of India | Jan 10, 2013

India, Mauritius to meet next month to review tax treaty

New Delhi: India and Mauritius will meet next month in the capital to review the bilateral Double Taxation Avoidance Convention (DTAC) which seeks to prevent misuse of the provisions of the near three-decade old treaty.

During his meeting with Mauritius Prime Minister Navinchandra Ramgoolam at Port Louis, Commerce and Industry Minister Anand Sharma expressed hope the two nations will be able to move forward on the issue at the Joint Working Group (JWG) meeting.

An official said India is likely to press for changes in the treaty so that information regarding source based taxation of capital gains could be shared between the tax authorities. India will also pitch for incorporating benefit limitation clauses in the agreement with a view to prevent ‘treaty abuse’.

The DTAC, notified in 1983, provides for taxation of capital gains arising from alienation of shares only in the country of residence of the investor. Reuters

Dates will be finalised soon, the official added. The JWG comprising members from the two sides was constituted in 2006 to put in place adequate safeguards to prevent misuse of the DTAC.

Eight rounds of discussions have taken place so far. India has said that it is making consistent efforts to find mutually acceptable solution for addressing the concerns. The DTAC, notified in 1983, provides for taxation of capital gains arising from alienation of shares only in the country of residence of the investor.

The release further said that during his meeting, Sharma appreciated the role played by Mauritius in the Indian Ocean Rim Association for Regional Cooperation (IOR – ARC). He also expressed satisfaction regarding the cooperation between the two countries in the hydrocarbon sector and proposed further cooperation in onshore and offshore drilling and exploration.

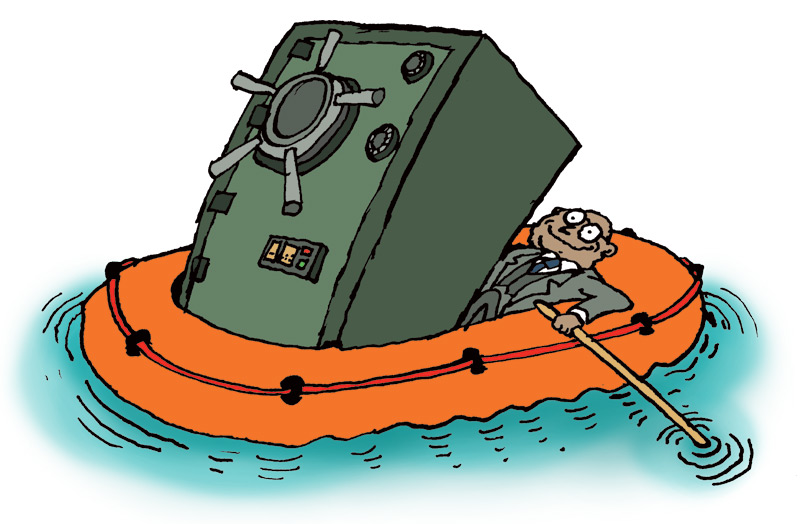

Capital gains are fully exempt from taxation in Mauritius under its domestic laws. Thus an investor routing his investment through Mauritius into India does not pay capital gains tax either in India or Mauritius. Mauritius thus has become an attractive route for investment by the third country residents into India through treaty abuse.

Sharma, who is on a two-day visit to the island nation, also announced that in addition to the existing Line of Credit of $250 million (announced during the visit of the Prime Minister of Mauritius in February, 2012), buyer’s credit to the tune of $100 million would be provided to Mauritius.

The Indian minister informed Ramgoolam that there was a need for deepening and diversifying trade and investment ties between the two

Towards this end, Sharma stressed upon the need for making the Mauritius India Business Council (MIBC) a robust institutional mechanism for giving a boost to trade and investment ties in sectors like, tourism, infrastructure, manufacturing and light engineering and pharmaceuticals.

The release said that it was agreed that a Joint Working Group on trade and investment would meet before April, 2013 to work out the modalities for broadening and deepening the economic engagement between the two countries.

Sharma who also holds the Textiles portfolio, it said, assured of full support for the development of the textiles sector in Mauritius. He also announced that 35 scholarships would be made available by India annually. Additionally 1,000 trainees from Mauritius would be provided training for skill development in the textiles sector and 10 factories in Mauritius would be taken up by the AEPC of India for compliance with the requirements of quality certification.

PTI