Trading down: Unemployment, inequality and other risks of the trans-pacific partnership agreement

Global Development And Environment Institute | 12 January 2016

Trading down: Unemployment, inequality and other risks of the trans-pacific partnership agreement

by Jeronim Capaldo and Alex Izurieta with Jomo Kwame Sundaram

Proponents of the Trans-Pacific Partnership agreement (TPP), the trade and investment treaty recently agreed by the United States and eleven Pacific Rim nations, emphasize the prospective economic benefits, with economic growth increasing due to rising trade and investment. Widely cited projections suggest GDP gains for all countries after ten years, varying from less than half a percentage point in the United States to 13 percent in Vietnam.

In this GDAE Working Paper, the authors employ a more realistic model that incorporates effects on employment excluded from prior TPP modeling. They find that benefits for economic growth are more limited, and they are negative in some countries such as the United States. More importantly, they find that TPP would lead to losses in employment and increases in inequality. This is true particularly for the United States, where GDP is projected to fall slightly, employment would decline, and inequality is projected to increase as labor’s share of income falls.

For this analysis, the authors use existing projections of TPP’s trade impacts and derive alternative macroeconomic projections using the United Nations Global Policy Model (GPM). This model provides more sensible projections because it allows for changes in employment and inequality and incorporates the impact those changes have on aggregate demand and economic growth. A previous GPM-based analysis of the Transatlantic Trade and Investment Partnership (TTIP) between the United States and Europe projected rising unemployment and inequality in Europe with negative impacts on aggregate demand and economic growth.

In this TPP study, the authors find:

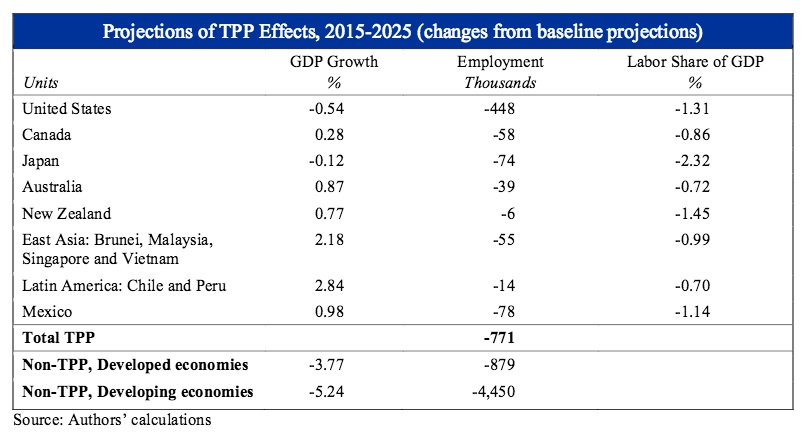

– TPP would generate net losses of GDP in the United States and Japan. For the United States, they project that GDP would be 0.54 percent lower than it would be without TPP, 10 years after the treaty enters into force. Japan’s GDP is projected to decrease 0.12 percent.

– Economic gains would be negligible for other participating countries – less than one percent over ten years for developed countries and less than three percent for developing ones. These projections are similar to previous findings that TPP gains would be small for many countries.

– TPP would lead to employment losses in all countries, with a total of 771,000 lost jobs. The United States would be the hardest hit, with a loss of 448,000 jobs. Developing economies participating in the agreement would also suffer employment losses, as higher competitive pressures force them to curtail labor incomes and increase production for export.

– TPP would lead to higher inequality, as measured by changes in the labor share of national income. The authors foresee competitive pressures on labor income combining with employment losses to push labor shares lower, redistributing income from labor to capital in all countries. In the United States, this would exacerbate a multi-decade downward trend.

– TPP would lead to losses in GDP and employment in non-TPP countries. In large part, the loss in GDP (3.77 percent) and employment (879,000) among non-TPP developed countries would be driven by losses in Europe, while developing country losses in GDP (5.24%) and employment (4.45 million) reflect projected losses in China and India.

These projections are largely the result of two changes in TPP economies. First, production for export would partially replace production for domestic markets, with negative consequences for the economy, as exports are less labor-intensive and use more imported inputs than production for domestic markets. Second, businesses in participating countries would strive to become more competitive by cutting labor costs, thereby seeking higher short-term profits while undermining efficiency and productivity in the long-term. As a result, the TPP would negatively affect income distribution, further weakening domestic demand and significantly undercutting possible gains from trade.

These projections should help TPP signatory countries and others assess the full range of economic impacts of the agreement before ratifying it.

Click here for the working paper