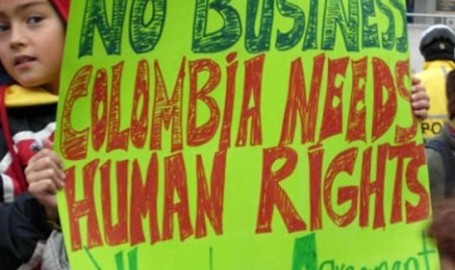

Pending Colombia-UK investment pact ‘undermines democracy and peace prospects’

Colombia Reports | Jul 10, 2014

Pending Colombia-UK investment pact ‘undermines democracy and peace prospects’

by Steven Cohen

The United Kingdom’s (UK) Parliament is expected to ratify an international investment treaty with Colombia Thursday that critics claim jeopardizes Colombian reform attempts and the future of the South American nation’s ongoing peace process with the FARC rebel group, reported the The Guardian newspaper.

Originally signed by both parties in 2010 and ratified by the Colombian Congress and President Juan Manuel Santos a year later, the bilateral investment treaty (BIT) is one of a number of such agreements Colombia has negotiated in recent years as part of the Santos government’s broad promotion of free trade economic policy.

Once signed into British law, the BIT would, in its own words, “create and maintain favourable conditions” for investment between the two countries, the problem for critics being that, while the United Kingdom is the second largest investor in Colombia behind the United States — which enjoys “preferred nation” status with Colombia, as well — Colombian business interests in the United Kingdom are not as robust.

In 2013, Colombia maintained a positive trade balance with the United Kingdom, but mostly on the back of commodities exports controlled by foreign rather than domestic companies.

Through November 2013, coal exports alone comprised 74% of Colombia’s trade to the United Kingdom on the year, according to figures reported by the national Portafolio magazine. The Colombian coal industry, the fourth largest exporter in the world, is dominated overwhelmingly by just four multinational companies, two of which, Anglo American and the recently acquired Xstrata, are headquartered in London.

The hydrocarbon and mining sector in general attracted 81.6% of Colombia’s record 2013 foreign investment, and the UK’s Royal Dutch Shell is among the companies to receive extensive exploration permits for offshore oil and natural gas reserves in the Colombian Caribbean.

For those and the more than 100 other British companies with operations in Colombia, the BIT would mean “treatment not less favourable than that accorded” to Colombian businesses, the standard pretext of free trade agreements. What worries critics specifically about the case of Colombia, however, is that those protections include guarantees against the “direct or indirect expropriation” of territory.

All about land

In Colombia, one of the most unequal countries in Latin America and the world, roughly 80% of the land is concentrated in the hands of 14% of the people, according to an Oxfam International report published last year. Similarly, a PBI Colombia study released in 2011 found that over 40% of Colombia’s land was titled to or being petitioned by multinationals.

With more than 5.7 million victims of forced displacement, Colombia has the second highest number of internally displaced peoples in the world behind Syria. Much of Colombia’s increasingly concentrated land, in other words, has been stolen from peasants during the course of the country’s 50-year armed conflict.

The 2011 Victims Law grants displaced peoples access to land reparations from the Colombian state. Many seeking redress for their grievances, however, have found their properties either occupied by or illegally sold to large corporations during their absence, often with the direct collusion of state officials.

In theory, the “public purposes” clause enumerated in the BIT would cover such situations, but under the terms of the treaty, a British company occupying stolen land would have a special legal recourse to avoid compliance with national law, according to The Guardian.

As is often the case in free trade agreements, the BIT would allow a British company to bring international arbitration against the Colombian government for violating the treaty’s expropriation protections, thereby circumventing Colombia’s own legal statutes on the matter. Even assuming the state would be able to win on decision, the costs involved in arbitration would pit the government’s interests against those of its citizens, argue human rights groups.

Implications for peace

Activists The Guardian spoke to also expressed concerns that territorial disputes could undermine peace talks between the Colombian government and the FARC rebel group, the country’s largest, which have been ongoing in Havana, Cuba, since November 2012.

The first agreement to emerge from the negotiations tackled the subject of agrarian reform, land inequality and theft being perhaps the primary cause for the FARC’s original formation in 1964. The details of the agreement have yet to be released to the public, but some sort of program for land redistribution is expected to have been included in the discussions, given the FARC’s consistent stance on the issue.

Should that be the case, the BIT would present another obstacle in the already complicated process of bringing the longest-standing civil war in the world to a meaningful end.

Lizzie McLeod, senior policy adviser at Traidcraft, a UK NGO, told The Guardian, “The investment treaty undermines democratic processes and the prospects of peace for the sake of UK profits.”

Andrea Saldarriaga, head of the Investment and Human Rights Project at the London School of Economics, went even further, saying that the BIT will not make any substantive difference in the area of Colombia-UK commerce, but that, “instead, it is creating unnecessary risks to the implementation of the government’s plans for the peace process.”

Where’s the humanity?

Colombia Reports has confirmed that at no point in the BIT text does the term “human rights” appear, nor does the document outline any responsibility foreign companies would have to take ongoing human rights situations into account.

These omissions confirm the fears of general free trade skeptics that the BIT privileges the expansion of private UK interests to the exclusion of the numerous humanitarian dilemmas that could arise as a result.

“While British business wants to protect any investments it has in Colombia via this treaty, not one British business seems to be concerned about the interests of the Colombian people,” said Lord John Monks, who serves as vice-president for the UK’s Justice for Colombia NGO.

On the Colombian side, CEDETRABAJO Director Enrique Daza told The Guardian, “It’s very bad for Colombia. It will give total power to the transnationals by promoting investors interests, while ignoring the wider society.”

British companies also don’t have the best human rights record in Colombia to begin with. British Petroleum (BP), for example, has breen brought up on at least two multi-million dollar class action suits by residents in eastern Colombia in the past decade..

The first, which was settled for an undisclosed amount that did not include an admission of guilt, alleged that BP was liable for the trail of paramilitary violence that followed its large-scale petroleum extraction efforts in the region. The second claimed that BP did not follow relevant environmental laws during the construction of a major oil pipeline, damaging the properties of farmers whose lands bordered the project, according to a separate The Guardian report.

Owned in part by two British multinationals, the El Cerrejon open-pit coal mine in northwestern Colombia has been tied to a litany of human rights concerns, including the paramilitary violence that has recently been associated, again, with the operations of the nearby Drummond Company.

Despite its abundant natural resources, La Guajira is among the poorest states in Colombia, and the mostly indigenous communities that border El Cerrejon face issues including food insecurity and the contamination of their lands, air, and waterways.

So why do it?

Proponents of the bill say it is a necessary step in shoring up burgeoning cooperation between the two countries, which is set to include investments in Colombia’s infrastructure, economic development, and education system over the course of the next decade.

“There’s the social infrastructure of hospitals, schools, public buildings, prisons, all of which need improvement, and much of the intention of the Colombian government is to do this through public-private partnerships […] and the UK might have more experience than any other country in the world in doing public-private partnerships,” Deputy Head of the UK Mission to Colombia Tony Regan told Colombia Reports, in a previous interview.

Infrastructure contracts are in Colombia are expected to be worth billions of dollars in the near future, as the country’s lack of a functioning roadway has hampered its economic development.

The Colombian government has painted the BIT as a central component in a similarly optimistic outlook for Colombo-British relations. The Colombian embassy in London told The Guardian, “As Colombia is actively aiming to integrate itself to an increasingly dynamic global economy, the UK-Colombian BIT provides the legal framework to guarantee the transparency and protection of investments.”

Colombia Reports has yet to find a sizable Colombian business interest in the United Kingdom on par with British companies’ activities in Colombia. Through April 2014, exports from Colombia to the United Kingdom are down 5.1%, when compared the previous year, according to Colombia’s national statistics agency (DANE).

Free trade in general has drawn hot criticism in Colombia, becoming one of the focal points of the ongoing national Agrarian Strike protest movement. So far in 2014, the trade balance between Colombia and the United States, its largest trade partner, has all but disintegrated into deficit from what was previously a strong and longstanding surplus.

A new free trade alliance with South Korea recently stalled in the Colombian Congress amid widespread opposition from trade unionists and the industrial and agricultural sectors.

Sources

- UK investment treaty with Colombia threatens fragile peace process (The Guardian)

- Bilateral Agreement (UK Parliament)

- Exporting to Colombia (UK Trade & Investment)

- Ley No. 1464 June 2011 (Colombia Congress)

- Colombia, destino de exportaciones 2014 (DANE)

- BP oil spill: Colombian farmers sue for negligence (The Guardian)

- BP pays out millions to Colombian farmers (Independent)