Today’s FTA frenzy

Todas las versiones de este artículo: [English] [Español] [français]

Today’s FTA frenzy

bilaterals.org and GRAIN

September 2007

The shift to bilateral FTAs as the tool of choice to push neoliberalisation today stands on two historic pillars: The North America Free Trade Agreement (NAFTA) showed what an FTA can do to drive the expansion of capitalist globalisation; and the collapse of the World Trade Organisation’s (WTO) Doha Round made space for many more NAFTAs.

NAFTA, signed between Mexico, Canada and the US in 1992, was an expansion of the Canada-US FTA which took effect in 1989. Due to NAFTA’s content and its North-South political and economic dynamic, it became something of a model for the next wave of bilateral trade deals. NAFTA broke new ground in:

- Tearing down tariffs on US farm imports. US maize, milk and other products became so cheap south of the Rio Grande that they could outsell Mexican goods. Over a million Mexican campesinos have been forced off their lands as a result, unable to compete against subsidised US agribusiness.

- Making it easier for US companies to set up shop in Mexico to assemble manufactured goods and ship them cheaply back to the US. The costs have been paid by Mexican workers: suppression of labour rights, increased social violence (especially against women) and the push towards emigration.

- Giving US and Canadian corporations the right effectively to sue the Mexican government for any policy decision or omission that directly or indirectly affects their expectations of making a profit from their investments in Mexico. The Mexican government has been sued for more than US$1.7 billion through 15 NAFTA investor-state disputes since 1996. [1]

- Providing a platform for the US government to impose security and immigration policies on Mexico (as part of the "partnership"), not to mention environmental and labour standards that serve the interests of US corporations. An example of what this means can be found in the biotechnology arena, where Mexico has taken the lead in pushing the legal pre-eminence of what FTAs say about the labelling of genetically modified foods within (and against) the biosafety protocol of the UN’s Convention on Biological Diversity. [2]

Simply put, NAFTA established a new paradigm in terms of what FTAs could achieve for TNCs.

While the full extent of NAFTA’s tremendous impact is still unfolding, the multilateral trade system has entered a serious state of inertia, giving unprecedented impetus to FTAs as a way to push trade and investment liberalisation forward. The current round of WTO trade talks - meant to reduce tariffs on imported farm and manufactured goods, open up trade in services, deregulate fisheries, etc - has hardly got anywhere. It failed to get started in Seattle in November 1999, due to internal tensions among WTO members regarding the speed and scope of WTO talks, growing resentment towards the dominance of a handful of Northern governments, and external pressure from massive street protests which rocked the city during the WTO members’ meeting. Shortly after the round started in Doha in November 2001, it hit bedrock in Cancún in September 2003, where political exasperation with both the EU’s and the US’s refusal to reduce internal agricultural subsidies while demanding that countries open up new areas for liberalisation was just too much for Southern governments, led by India and Brazil. Negotiations collapsed once again in Geneva in July 2006. Subsequent attempts to revive the talks have thus far been unsuccessful, although it would be unwise to dismiss the WTO altogether.

Two moments in this series of crises stand out:

- Cancún triggered a significant shift of pressure and focus towards FTAs. Robert Zoellick, then US Trade Representative, immediately retaliated with his "competitive liberalisation" programme, whereby the US would pit Southern countries against each other to fight for US market access on a select one-by-one bilateral basis. In no time, Washington announced FTA negotiations with Thailand, Ecuador, Peru, Colombia and, soon after, five countries in Central America. Japan, China and many other Asia-Pacific governments also started looking much more earnestly into FTAs and jumping into negotiations. It was during this period that many people adopted Columbia University economist Jagdish Bhagwati’s phrase "spaghetti bowl effect" to describe the dangers of a complicated web of divergent bilateral trade rules replacing a more coherent multilateral regime that only a global forum like the WTO could maintain.

- The suspension of the Doha Round in July 2006 triggered yet another serious shift towards FTAs. While the US did not start new negotiations as a result, the EU was boosted into launching major new FTA talks with 21 countries in Latin America and Asia. By then, however, much had already changed since Cancún. Latin American countries had more or less "buried" the Free Trade Area of the Americas (FTAA) initiative, and some, led by Venezuela, had embarked on a rival Bolivarian Alternative for the Americas (ALBA). Venezuela had bolted from the Andean Community and joined Mercosur in protest against several Andean states’ FTAs with Washington. The 77 African, Caribbean and Pacific countries of the ACP group were entering into the last phase of their negotiations with Brussels on economic partnership agreements (EPAs). And China - having secured partial but significant deals with Thailand and with ASEAN as a whole, besides starting to engage the West by initiating comprehensive FTA talks with New Zealand and then Australia - was embarking on a broader multi-tiered FTA strategy.

Compliance with WTO agreements has been brutally difficult, but bilateral deals with WTO-plus provisions are often even tougher. The bilaterals strategy is quite clearly seen by EU and US trade negotiators as a way to push governments into going further and faster while they fail to get their way at the WTO.

FTAs in relation to the WTO

While the two may seem like different directions, bilateral FTAs and the multilateral WTO bounce off each other in many ways.

- FTAs appear more limited than the WTO in terms of who they affect - but it’s just an appearance. A Canada-Korea FTA, for instance, will mainly affect business opportunities - and therefore jobs, social rights and all sorts of regulatory frameworks governing markets - between Canada and Korea. But because of the "most favoured nation" principle that all WTO members must respect, any privileges granted by Korea to Canada under such an FTA would have to be extended to other nations that enter similar agreements with Korea. So while FTAs are limited to the countries involved, there is a built-in snowball effect to extend bilateral market privileges to others. This greatly facilitates the development of new international rules and standards in a bottom-up way. Rather than negotiate policies or best practices - e.g. to break down investment barriers - at a global (i.e. visible and slow) level, countries can create a series of faits accomplis by spreading them through bilateral deals. This viral effect is a major advantage of FTAs to powers such as the US, Switzerland, Japan and the EU. Big powers can effectively speak of "emerging international standards" - e.g. on broadcasting rights, copyright terms or pharmaceutical data protection - and then force everyone else into line.

- North-South FTAs go much further than the WTO. FTAs between industrialised countries and Southern countries are generally WTO-plus. They use WTO agreements as a minimum standard and go further. This has been happening in the areas of intellectual property (TRIPS), investment, and services (GATS) - the three areas that industrialised countries are most interested in seeing reformed for the benefit of their corporations. The US, EU and EFTA have been most adept at using FTAs for this purpose. Until now, Japan has been more willing to back down when negotiating partners protest, for example on IPR, though this may change soon. [3] FTAs between Southern countries generally do not impose major policy changes on each other, much less WTO-plus policies. One big exception to the WTO-plus character of North-South FTAs is migration. First World capital should be free to move across borders, but the mobility of Third World workers remains a delicate matter. [4]

- FTAs detract from the WTO achieving its ends. The WTO allows for FTAs under certain conditions. [5] FTAs are regarded by the WTO as, at best, "exceptions" to the rule of non-discrimination in trade relations. They are tolerated as extracurricular pursuits while the “real business” of reforming global trade rules must take place at the all-encompassing multilateral level. Pundits and politicians fight over whether FTAs damage the WTO (by dispersing negotiating capacity and diverting trade itself) or actually support it (by promoting trade liberalisation in reality). What is clear is that much energy is going into designing piecemeal trade agreements far away from the slow-moving WTO. [6] Meanwhile, major Southern countries such as China, India and Brazil are gaining a bigger and bigger share of the trade pie (not because of FTAs, but because of aggressive domestic agendas). FTAs allow countries to pick and choose their privileged trade partners (markets), while trade power is shifting.

- FTAs serve a much broader purpose than the WTO. While FTAs simultaneously do less and more than the WTO, and hold the WTO back from achieving new levels of consensus around trade reform, the comparison stops there. While FTAs have a trade-spurring component - whether on the basis of competition or cooperation or both - they are primarily tools to move relationships forward. In the case of North-South agreements, these are usually relationships of domination. For instance, the US lowers its tariffs for some Colombian exports ("market access") and in return gets untold freedom and sovereignty for its corporations to operate in Colombia. A country like the US does not choose a country like Colombia for an FTA because it’s a large trading partner, but for geopolitical reasons: e.g. to secure a presence in Latin America, to isolate and undermine President Chávez of neighbouring Venezuela, to get more leverage on Colombia to allow the aerial spraying of coca crops, to operate more closely in the war against the FARC guerrillas, and so on. In South-South agreements, there is also some power posturing, but most of these deals play out in a regional context where some amount of cooperation-building is necessary. FTAs are both tools of foreign policy and economic instruments used by individual governments (or regional groups of states).

|

"Bilateral and regional FTAs in the Asia-Pacific are formalised manifestations of where our respective private sectors have taken us ... it is really business and government moving in tandem.”

— Susan Schwab, office of the US Trade Representative, 2006 [7] |

Corporates setting the agenda

FTA negotiating objectives are formed by corporations and governments working closely together. For instance, US agribusiness and pharmaceutical corporations are both the scriptwriters and cheerleaders of TRIPS-plus provisions in FTAs. The US government’s Industry Functional Advisory Committee on Intellectual Property Rights for Trade Policy Matters (IFAC-3), in its April 2004 report on the IPR provisions of the US-Morocco FTA, states that it “welcomes the pledge made by Morocco to provide patent protection for plants and animals and the confirmation made by both Parties that patents shall be available for any new uses or methods of using a known product for treating humans and animals. This will make available patent protection for transgenic plants and animals that are new, involve an inventive step and are capable of industrial application." The Committee goes on to note that "this is a significant improvement over the commitments made by Chile and CAFTA in their FTAs and urges US negotiators to insist in all future FTAs that patent protection be made available to both plants and animals.” [8]

It is very clear that this is a global, not case-by-case, strategy for US industry. IFAC-3 is a veritable powerhouse of US corporate titans. Its members include Pfizer, Merck, Eli Lilly, the Biotechnology Industry Organisation, the Pharmaceutical Research and Manufacturers of America (PhRMA), Time Warner, Anheuser-Busch, and the private sector coalition for US copyright-based industries, the International Intellectual Property Alliance. [9] As intellectual property expert Peter Drahos puts it, “IFAC is a committee that gets its hands dirty by reviewing and drafting specific agreements. It does this technical work across all US trade initiatives in intellectual property, whether bilateral, regional or multilateral. It is thus able to co-ordinate at a technical level the work it does across these different fora, thereby ensuring that US trade negotiating initiatives push intellectual property standards in the direction that US industry would like. The technical expertise on IFAC, as well as the expertise available to it from the corporate legal divisions of its members means that, for example, it can evaluate a country’s intellectual property standards in detail when that country seeks WTO accession and it can provide detailed assessments of the standards that USTR negotiators must bring home in a negotiation.” [10]

The Secretariat of the US-Thailand FTA Business Coalition comprises the US-ASEAN Business Council, representing US corporations with interests in ASEAN, and the National Association of Manufacturers (NAM), the largest industrial trade lobby group in the US. NAM boasts: “Our voice is not compromised by non-industry interests.” [11] FedEx, General Electric Company, New York Life, Time Warner and Unocal are corporate chairs of the Coalition. Steering Committee members include: AIG, Cargill, Caterpillar, Citigroup, Corn Refiners Association, the Coalition of Services Industries, Dow Chemical, Ford, the National Pork Producers Council, PhRMA, PriceWaterhouseCoopers, Securities Industry Association, United Parcel Service and the US Chamber of Commerce. [12] These business coalitions play an integral role in forming US negotiating objectives for FTAs and are quite open about their self-interest and eagerness to keep raising the stakes. An important corporate backer of the recently signed US-Korea FTA was the American Insurance Association, which seeks to crack open the world’s eighth largest insurance market. BusinessEurope (formerly the Union of Industrial and Employers’ Confederations of Europe - UNICE) is also upfront about its goals for FTA deals: “Given the increasingly important role of services in EU exports, all future FTAs must ensure comprehensive liberalisation of key sectors including financial services, telecommunications, professional and business services and express delivery services. ... The EU has a comparative advantage across the board in services and needs to ensure that this advantage is pressed home in future FTAs.” [13]

Nippon Keidanren - Japan’s big business federation - was a key pressure group in shaping Tokyo’s FTA ambitions towards Singapore, Mexico, South Korea and Indonesia. New Zealand dairy conglomerate Fonterra, formed by merger of the country’s two largest dairy cooperatives and the New Zealand Dairy Board, enjoys a close relationship with the country’s trade officials and is an aggressive proponent of agricultural trade liberalisation. Fonterra is a key supporter of a China-New Zealand FTA, as it wants to edge in on China’s growing demand for dairy products. The Australia-China Business Council, which is actively lobbying for a China-Australia FTA, has as its vice-presidents the presidents of Australia/Asia Gas and BHP Billiton Petroleum, and a corporate relations executive from Rio Tinto.

But Southern TNCs, such as Thailand’s Charoen Pokphand (CP), have also been active players in influencing FTA talks for their own interests, which often run counter to those of small farmers. “Our Prime Minister Thaksin Shinawatra has discussed with the Prime Minister of Japan that Thailand will give up its insistence on withdrawing rice from the [Japan-Thailand FTA] negotiation in order to make the negotiations move forward. I think that Japan should prove its sincerity by not withdrawing other products such as shrimp, chicken and seafood,” said Pornsilpa Patcharintanakul, CP senior executive and vice-secretary of Thailand Chamber. [14]

Key points to understanding FTAs

To understand the overall FTA game, we have to look across all the different processes and draw out the key features of these agreements. It’s not hard to do - and it’s critical to understanding their power and how we may fight them.

FTAs are just one tool: Despite the strong focus on FTAs, no one puts all their eggs in one basket. Big powers like the US or the EU are especially adept at using a whole range of instruments to coerce smaller countries into following their economic policy prescriptions. They use the UN agencies, the international finance institutions (World Bank, International Monetary Fund, regional development banks), the WTO, their own development aid machinery, unilateral policies and plain old carrot-and-stick deals to build alliances and secure policy change. Even though FTAs dig deep, it’s important not to see them as the only thing going on.

Not all FTAs are created equal: [15] Some FTAs are essentially about domination. Others are more about cooperation. Most will inevitably mix these two, but to different degrees.

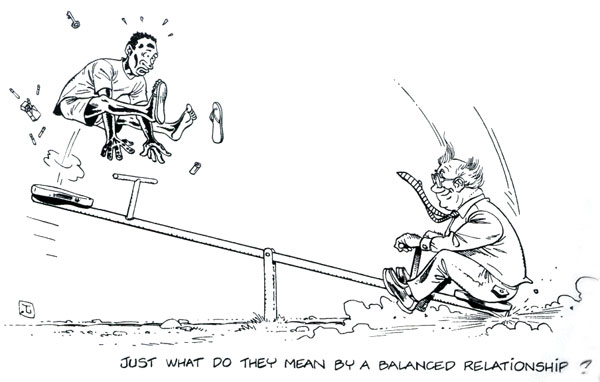

North-South FTAs are generally designed to open Southern countries to private companies of the North, giving them freedom to operate. They do this particularly through investment, IPR and services provisions. (Bilateral investment treaties do the same.) These three are the most significant chapters of FTAs for industrialised countries, though there are many others which are also important (see box: Anatomy of an FTA). Southern countries are supposed to get increased market access: they are supposed to be able to sell more in the “developed” country as lower tariffs make their goods (and services, if they export any) more competitive. Reciprocity between two unequal partners does not make them equal, but, rather, reinforces unequal power relations. To make this whole scheme work, Northern countries often toss in some cash hand-outs for trade capacity-building or development cooperation - friendly "sugar" to help the bitter "medicine" of dominance go down.

South-South FTAs, which are mushrooming at present, are invariably weaker agreements. Until now, they have mainly been tariff reduction schemes: the two (or more) parties agree to lower the tariffs they apply to each other’s exports and only for a limited list of goods. [16] Latin American governments entered into a lot of such deals as they moved out of import substitution and into export-oriented development strategies in the 1980s. Lately, this kind of simplistic FTA has become popular with Asian governments as a way of stoking regional trade and further testing the potential of economic integration, which, despite years of official talk, has still not amounted to much in Asia. Today, however, South-South FTAs are starting to expand from mere tariff reduction schemes to broader economic liberalisation pacts addressing both services and investment. But they still do not dictate policy changes on the signatory states the way North-South agreements do.

|

Anatomy of an FTA A typical "comprehensive" US FTA can cover 20 issues.

Several of these issues have been declared "non-negotiable" by Southern governments at the WTO. |

FTAs are driven by wider concerns than "trade": They are mostly driven by a mixture of geopolitical, security and economic concerns. Geopolitical concerns - power relationships between countries - are quite evident in the US and EU FTAs, not only in the choice of countries that they pursue FTAs with but also in the contents. Some examples:

- The US is using FTAs to undermine social and political opposition to Israel in the Middle East and the broader Arab world. Examples are FTAs concluded with Jordan, Bahrain and Morocco; the Palestinian component of the US-Israel FTA; the US-sponsored Egypt-Israel Qualified Industrial Zones; games played with Egypt (where the US dangled an FTA carrot, withdrew it, dangled it again and withdrew it again depending on the issue of the moment); and the overall US-Middle East FTA project.

- US FTAs in the Arab world have created significant problems for regional alliances such as the Gulf Cooperation Council (GCC) and the Arab League. One GCC rule is that no member can independently enter into an FTA with a third party. Bahrain broke that rule by signing with the US, causing tremendous strain on the group for several years. Further US deals with Oman and talks with the UAE created a fait accompli that the GCC - especially Saudi Arabia - was forced to accept. Bahrain has had to drop out of the Arab League’s longstanding boycott of Israel because of its FTA with Washington. The US-Morocco deal prevents Morocco from applying trade preferences to third parties that are not net exporters of certain agricultural products. Hence Morocco cannot fully implement its commitments under the Agadir Agreement, an FTA between four Arab countries that is meant to be a springboard toward the Arab League’s own FTA. And there is the "capitalism stops terrorism" hype. Announcing the start of talks on a US-Pakistan BIT in September 2004, Robert Zoellick said: “Pakistan and the United States are partners in combating global terrorism. A BIT based on the high standards contained in our model text can play an important role in strengthening Pakistan’s economy, so as to create new opportunities for exporters and investors in both economies and assist in meeting the economic conditions to counter terrorism.” [17]

- In Latin America, FTAs have been used by Washington for various geopolitical purposes: to control the border with Mexico (through NAFTA), to create a buffer to Chávez (by offering a TIFA, a BIT and an FTA to Uruguay, which has divided Mercosur, an economic cornerstone that Chávez would like to rely on), to isolate Brazil (again by courting Uruguay and detabilising Mercosur) and to maintain economic (e.g. the Panama canal) and military dominance in the region (particularly in Colombia, where US military advisors are stationed near the Venezuelan border helping the Colombian military fight FARC. As in the Middle East, Washington’s FTA drive in Latin America has also put tremendous strain on regional blocs - not only Mercosur but also the Andean Community. When the US Senate gave its "thumbs up" to the US-Peru FTA, the business world gushed: "As Peruvians [now] gain choices about their future, they won’t have to turn to Chávez for answers." [18] Bush is now lobbying Congress to ratify the US-Colombia deal as “the main US policy tool” to stop Chávez. [19]

- EU FTAs explicitly address military issues. The initialled agreement with Syria has a special provision committing Damascus to the pursuit of a "verifiable Middle East zone free of weapons of mass destruction, nuclear, biological and chemical, and their delivery systems". [20] The EU has been seeking the same with Iran, and even managed to stop (at least temporarily) Tehran’s uranium enrichment programme as a basis for the resumption of FTA talks. [21] Meanwhile, Brussels has been stammering over whether to include or delete a weapons of mass destruction clause in its FTA with nuclear power India, [22] and moving towards a broader commitment not only to prevent the "proliferation of WMDs" but to "fight terrorism" in forthcoming FTAs with Central America and the Andean Community. [23]

- The Australian government’s FTA game plan is starting to merge brazenly with military objectives. Prior to the launch of FTA talks with Japan in 2007 it signed a joint security cooperation pact with the officially demilitarised country. [24] Plans for an Australia-Israel FTA, to be concluded in time for Israel’s 60th birthday in 2008, are tightly linked to plans for joint defence cooperation, in addition to the business opportunities in high-tech weaponry sales that the deal is expected to provide. [25]

|

”The sense that is now being conveyed around the world is that US policy is to sign FTAs with other countries only if they are prepared to adhere to US foreign policy positions. An FTA, in other words, is not necessarily an agreement for which all parties benefit from trade expansion but rather a favor to be bestowed based on support of US foreign policy.”

— Sidney Weintraub, Centre for Strategic and International Studies [26] |

The strong foreign policy agenda underpinning US FTAs helps to explain why Washington picks countries with whom the US trades very little for FTAs. It’s hard to disentangle geopolitical concerns from the security issues that drive FTAs. The security issues are not just about guns and borders. Security agendas pursued through FTAs extend visibly today to energy and food, even if these rely on trade.

- Countries like China, Japan, the US and the EU - all big FTA pushers - are highly dependent on foreign countries for their energy needs. In its pending deal with Brunei, Japan has included for the first time a chapter on energy, assuring Tokyo a guaranteed supply of oil and gas. The same was achieved under the Japan-Indonesia FTA. The long-pending FTA between the EU and the GCC, under negotiation since 1990, is supposed to allow EU ownership of petrochemical companies in the Gulf states. India’s tariffs on oil palm, used for the production of agrofuel, have been a knotty concern holding up the India-ASEAN FTA.

- Japan and China are highly dependent on the outside world for their food security, and this is reflected in their FTA strategies. FTAs provide an assurance to Japan of certain food supplies for which it can impose specific health and safety standards on the provider country. With the ASEAN countries, Japan has worked out provisions on tropical fruit and seafood; with Australia it will work out beef and dairy, and any potential FTA with China will certainly specifically cover vegetables and oilseeds. Japan’s food security concerns also translate into systematically keeping rice out of its FTAs, in order to maintain high tariffs on imports (up to 500%) and keep its domestic rice industry viable, and negotiating improved access to fishing waters. China’s food security agenda shows up vividly in Asia, where the Chinese are seen to be building up, for the long term, an outsourced food supply support system. Liberalisation of agricultural trade has been the first impact of the China-ASEAN FTA, the China-Thailand FTA and the China-Philippines agreements. [27] Part of this impact is the flooding of local markets with cheap Chinese fruits and vegetables, driving Thai and Filipino farmers into serious difficulties. But the other part is the influx of Chinese land acquisitions and corporate investment to develop local food production for export to China, especially in staple foods like rice. [28]

The economics are basic - but potent: North-South FTAs and BITs are really tools to expand the investment rights, opportunities and environments for TNCs from the North. Within this frame, property rights - and most specifically IPRs - are a crucial factor. Investment rights and property rights are almost two sides of the same coin: what is at stake is control over assets. Many FTAs and BITs specifically include IPR in their definitions of “investment”. That means private control over private assets, above and against public interest and previously held ideas about the role of the State. That is what most North-South FTAs boil down to: expanding control and ownership over productive resources for the benefit of TNCs with historical roots in the North.

FTAs deliver this control by setting norms and standards - pushed by the North - that both parties eventually agree to. Once they agree, governments of the South often have to rewrite a number of their domestic laws to reflect those standards, and both parties will set up joint bodies to see the agreement implemented. To make sure it all works, a number of dispute settlement mechanisms are built in.

Several World Bank and UNCTAD studies show that there is no direct relationship between signing an investment agreement and receiving increased foreign investment. China, South Africa and Brazil are prime examples of countries that have captured big investment inflows in recent years without such agreements. Indeed, signing such an agreement can get you into costly legal disputes for failing to deliver the right investment conditions, resulting in net financial losses.

The rights for TNCs that are created through these agreements include the right to:

- be treated no less favourably than domestic companies (“national treatment”)

- get any "better" treatment that is offered to TNCs under other trade deals (“most favoured nation”)

- enjoy secure ownership of all assets: no expropriation (whether direct or indirect), no nationalisation and fewer possibilities for the State to issue compulsory licences in the public interest

- realise any anticipated profits - and to sue the State if any public policy measure or decision gets in the way of that

- conduct business with minimal hassle from the government: no requirements to hire local workers, no obligations to transfer technology, full freedom to send money out of the country and generally few restrictions on moving capital around

- have direct access to local policy-making processes

- expand their commercial monopolies through a longer menu of intellectual property rights (trademarks over sounds and scents; patents on plants and animals; longer copyright and patent terms; extension of pharmaceutical patents to test data, to prevent the marketing of generics; new geographical indications, issued on a first-come-first-served basis; extension of copyright to encrypted satellite transmissions; etc.) and state commitments to enforce those rights.

After the control agenda comes the opening up of new markets. FTAs are breaking new ground as they reach into sensitive areas that governments can’t agree on at the WTO: services, investment, electronic commerce, even parts of agricultural trade and fisheries. All North-South FTAs cover trade not only in goods but in services as well. Services account for 60-70% of industrial economies, in terms of jobs and income, and have been the fastest-growing sector of world trade in the past 15 years. The EU is the single biggest exporter of services in the world (52%), followed by the United States, China and Japan. [29] Many countries are counting on building their future wealth through increased trade in services. FTAs play a key role in this by committing countries to "open up" - deregulating and privatising - services trade beyond levels required at the WTO. This means allowing foreign corporations to do business in sectors where they otherwise cannot. This may be in education, banking, accounting, legal services, insurance, pensions, media (newspapers, radio, television) and entertainment, telecommunications, transportation and delivery services (post, courier), utilities (power, water), medical services (hospitals), food retailing and even security. Under the strongest North-South FTAs, this is an invitation for Western companies to come and take over huge areas of what used to be considered public services and the role of the State. As many experiences show - especially in water privatisation - this leads to a degradation of living standards, especially for the poor, as prices go up (making services inaccessible) while accountability goes down.

For Southern countries, the main interest of FTAs is to gain potential market access. This comes at huge costs.

- Under North-South FTAs, the market access for the South is generally very small. For the Japan-Philippines Economic Partnership Agreement (JPEPA), Japan got improved access to the Philippines automobile market, new fishing opportunities in the Philippine seas (to replace imports), stronger investment guarantees and even the green light to export toxic wastes, while the Philippines got reduced tariffs on a few exported fruits and a quota to be able to send 100 nurses a year to Japan. In the Japan-Thailand deal, Japan got major new investment opportunities in the automobile and health sectors, [30] while Thailand got a measly quota to send chefs and masseuses to Japan.

- In agriculture, the imbalance is terrible. Third World countries generally have to dismantle agricultural protections, in the form of tariffs and price controls, while the industrialised country does not have to touch its farm subsidies which form the basis of dumping. The US-Colombia agreement is a stark example. In the first year of the FTA, it is estimated that US farm exports to Colombia will grow 73 times more than Colombia’s farm exports to the US. [31]

- Many North-South FTAs pit neighbouring Southern countries in competition against each other for small market openings of a few products. For instance, Japan has individually promised the Philippines, Thailand and Indonesia, in their separate FTA talks, great new openings for their mangoes and shrimp. But the Japanese can only consume so many mangoes and shrimp. Yet exporters in all three countries were led to believe that they were getting special deals on a privileged basis. The same has been happening in Latin America, where the US has promised Colombia, Ecuador and Peru great export opportunities for mango in exchange for what in effect will be the destruction of their domestic production of cereals, meat, dairy and oil crops. [32]

While there are exceptions, market access for Third World countries under North-South FTAs is mostly a mirage. Many Southern countries are specialised in a few primary exports that are increasingly structurally controlled by TNCs. FTAs push them further into that trap, rather than supporting diversification - much less food sovereignty. Southern governments are increasingly trying to apply the same formula to regional trade agreements among themselves, without necessarily addressing the problem of their structural similarities leading to pointless competition.

Keeping the public out: Secrecy invariably shrouds FTAs. Negotiated behind closed doors, only a small group of government-appointed experts is involved, texts are kept secret until they are signed, and in most cases elected representatives have little or no say in the matter. Why countries are negotiating them, what is negotiated, who is involved from the corporate sector, what the impacts will be: these are some of the questions that come up all the time and get the same lame answers. We are told that everyone is doing it, and that we can’t afford to be left out, that we cannot know the details of what is being negotiated because it is sensitive, but to trust that we will see new jobs and new business opportunities as a result.

Ultimately, the biggest problem with the secrecy that shrouds FTA talks is not so much the lack of public knowledge or participation in the process. It is the fact that many FTAs subvert national laws, take authority away from national legal systems and undermine principles established in state constitutions.

The economic hype, the language of fighting terrorism through liberalised trade and investment, and the talk of upholding democracy that surround these bilateral agreements reminds us that neoliberalism and the brute force of imperialism march hand in hand in the 21st century. With the demonisation and criminalisation of many peoples’ movements against FTAs as enemies of the state, to be confronted with repression and brutal security operations, such connections are not far removed from many daily struggles for justice, dignity and survival.

Notas:

[1] For details see Scott Sinclair, "NAFTA dispute table", Canadian Centre for Policy Alternatives, March 2007, at http://policyalternatives.ca/documents/National_Office_Pubs/2007/NAFTA_Dispute_Table_March2007.pdf

[2] See GRAIN and the African Centre for Biosafety, "Bilateral biosafety bullies", October 2006, http://www.grain.org/briefings/?id=199.

[3] See GRAIN, "Japan digs its claws into biodiversity through FTAs", Against the grain, August 2007, http://www.grain.org/articles/?id=29

[4] There are currently 192 million migrants in the world, most of whom are nationals of Third World countries who have gone to industrialised countries to find work.

[5] These conditions are laid out in what is called GATT Article XXIV. It says that WTO members can engage in sideline FTAs as long as they: (a) eliminate, and don’t just reduce, tariffs and non-tariff barriers (b) within a reasonable period of time (usually interpreted as 10-12 years) and (c) cover "substantially all trade" between the parties (usually interpreted as 85-90%). GATT Article XXIV applies only to trade in goods and, as such, does not allow for "special and differentiated" treatment between countries. FTAs covering trade in services have to abide by Article 5 of the GATS Agreement, which does allow for special and differentiated treatment, as well as a few more flexibilities.

[6] For all its rules and bureaucracy, the WTO doesn’t really monitor FTAs. A committee is supposed to review them, to make sure that Article XXIV and so on are being respected. But although the committee meets, this work has hardly happened since the WTO began operations in 1994. Out of the 194 FTAs submitted to the committee for review as of March 2007, only 19 have gone through the full examination procedure - a paltry 9%.

[7] "Transcript: Susan Schwab interview", Financial Times, London, 17 November 2006. http://www.bilaterals.org/article.php3?id_article=6505

[8] The US-Morocco Free Trade Agreement (FTA): The Intellectual Property Provisions. Report of the Industry Functional Advisory Committee on Intellectual Property Rights for Trade Policy Matters (IFAC-3), 6 April 2004. http://www.ustr.gov/assets/Trade_Agreements/ Bilateral/Morocco_FTA/Reports/asset_upload_file164_3139.pdf

[9] Ibid.

[10] Peter Drahos, "Expanding intellectual property’s empire: the role of FTAs", Research School of Social Sciences, Australian National University, Canberra, November 2003. http://www.grain.org/rights/tripsplus.cfm?id=28

[11] NAM At A Glance. NAM Website: www.nam.org/s_nam/doc1.asp?CID=53&DID=224181

[12] US-Thailand FTA Business Coalition website. http://www.us-asean.org/us-thai-fta/

[13] "UNICE strategy on an EU approach to free trade agreements”, Union of Industrial and Employers’ Confederations of Europe, Brussels, 7 December 2006, http://www.bilaterals.org/article.php3?id_article=7265

[14] Quoted in the SiamRath Daily of 27 October 2004.

[15] Aside from the domination-cooperation spectrum, FTAs differ a lot by name and nuance. We have free trade agreements (FTAs), preferential trade agreements (PTAs), economic cooperation agreements (ECAs), economic partnership agreements (EPAs), comprehensive economic partnership agreements (CEPAs), strategic economic partnership agreements (SEPAs), comprehensive economic cooperation agreements (CECAs), regional trade agreements (RTAs), association agreements (AAs) and so on.

[16] These are usually referred to as "preferential trade agreements" (PTAs) or even "partial" PTAs.

[17] "United States, Pakistan Begin Bilateral Investment Treaty Negotiations", USTR press statement, 28 September 2004, http://www.state.gov/e/eb/rls/prsrl/2004/36573.htm

[18] "Peru is in, now where’s Colombia?" Business Investor’s Daily, Editorial, 4 December 2007. http://www.investors.com/editorial/editorialcontent.asp?secid=1501&status=article&id=281664179614983]

[19] Agence France-Presse, "Bush wields Colombia trade deal to halt Venezuela", Washington DC, 8 December 2007, http://www.bilaterals.org/article.php3?id_article=10626

[20] EU-Syria Association Agreement of 2004, Article 4, at http://www.bilaterals.org/IMG/pdf/com2004_0808en01.pdf

[21] Dilip Hiro, “No Carrots, All Stick”, Mother Jones, 8 November 2004, http://www.bilaterals.org/article.php3?id_article=941

[22] "EU aide worried by calls to drop India WMD clause", Reuters, 2 March 2007, at http://www.bilaterals.org/article.php3?id_article=7311

[23] Draft EU-CAN negotiating directive at http://www.bilaterals.org/article.php3?id_article=8334 and draft EU-Central America negotiating directive at http://www.bilaterals.org/article.php3?id_article=8336. No mention of terrorism or WMDs appears in the draft EU-ASEAN negotiating directive.

[24] Kyodo, "Japan, Australia strike strategic security cooperation agreement", Tokyo, 13 March 2007. http://www.bilaterals.org/article.php3?id_article=9759

[25] Mark Dodd, "Israeli deal to boost defence", The Australian, 26 September 2007. http://www.theaustralian.news.com.au/story/0,25197,22483470-15084,00.html

[26] Sidney Weintraub, "The politics of US trade policy", BBC, 3 September 2003. http://news.bbc.co.uk/1/hi/business/3169649.stm

[27] See: the China-ASEAN section of bilaterals.org at http://www.bilaterals.org/rubrique.php3?id_rubrique=95; Kingkorn Narintarakul, "Thai-China free trade agreement for whose benefit?", Asia Pacific Network on Food Sovereignty (APNFS), 2004 at http://www.apnfs.org/docs/apnfs2004kingkorn.pdf; Natividad Bernadino, "The ASEAN-China free trade area: issues & prospects", APNFS, 2004 at http://www.apnfs.org/docs/apnfs2004naty.pdf

[28] GRAIN, "China-Philippines hybrid rice tie-up", 29 October 2002 at http://www.grain.org/hybridrice/?lid=18 and "Hybrid rice and China’s expanding empire", 6 February 2007 at http://www.grain.org/hybridrice/?lid=176. See also TJ Burgonio, "Probe sought on biofuels pacts between RP and China", Philippine Daily Inquirer, 20 May 2007, at http://newsinfo.inquirer.net/breakingnews/nation/view_article.php?article_id=67037

[29] WTO, "World Trade Report 2006", p. 12.

[30] Japan is expected to invest heavily in the health tourism industry in Thailand for rich and ageing Japanese.

[31] Aurelio Suárez Montoya, "Agrio balance del agro en el TLC", RECALCA, March 2007, at http://www.recalca.org.co/AAdoceducativos/4_AGRIO_BALANCE_AGRO_TLC.pdf

[32] Aurelio Suárez Montoya, "La CAN obtiene nichos para comida exótica y entrega todos sus mercados masivos de cereales", BolPress, 5 November 2005, at http://www.bolpress.com/art.php?Cod=2006051132